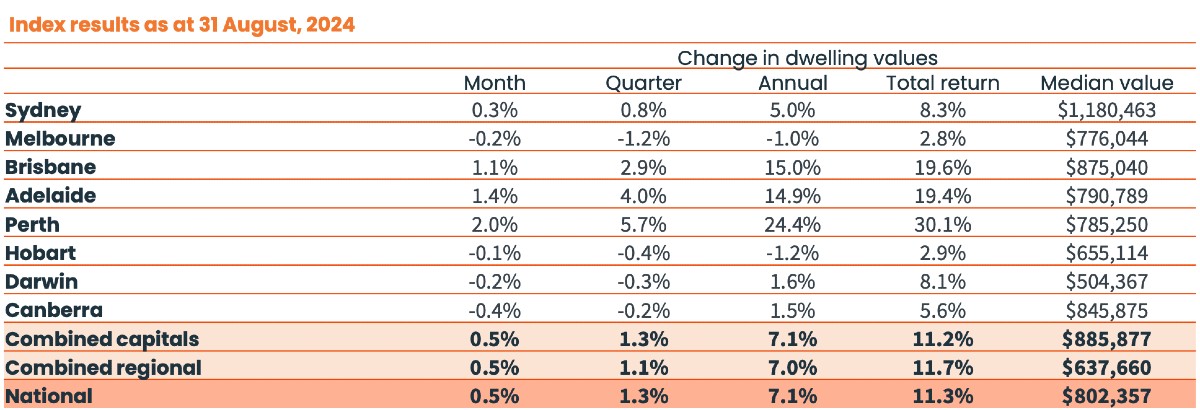

This was revealed by the latest CoreLogic's Home Value Index (HVI).

As of 31 August, the median dwelling value in Melbourne is $776,044, down 0.2% from a month ago and lower by 1% compared to the year prior.

The fall is much greater over the quarter, plummeting 1.2%.

This puts Melbourne behind mid-sized capitals Brisbane, Adelaide, and Perth.

In comparison, the median dwelling value in Brisbane climbed 1.1% from a month ago to $875,040, while Adelaide was up 1.4% to $790,789.

Perth recorded the strongest growth, with a 2% monthly increase, a 5.7% rise over the quarter, and a substantial 24.4% annual gain, bringing its median dwelling value to $785,250.

Brisbane had previously overtaken Melbourne in dwelling values to claim the third spot in Australia's top property markets before the Victorian capital regained the position.

However, Adelaide outperforming Melbourne in median dwelling values marks the first time it has happened in CoreLogic's 40-year series.

Additionally, this is the first time Perth's median dwelling value has exceeded Melbourne since February 2015, when the city was just coming off the highs of an iron-ore boom.

"In August, Adelaide and Perth saw increases in the median dwelling value of $13,600 and $15,300, respectively, against a -$3,100 fall in the Melbourne median," CoreLogic head of research Eliza Owen said.

CoreLogic however clarified that the median dwelling value is "highly skewed by the portion of units" in each market.

Melbourne's median is weighed down by the composition of housing in the city, where a third of homes are units, compared to about 16% in Perth and Adelaide.

Separately, the median house and unit values across Perth and Adelaide are still lower than in Melbourne.

Nationally, the median dwelling value rose by another 0.5%, reaching $802,357 by end-August.

CoreLogic Home Value Index (HVI) reveals the median dwelling value in Melbourne falls below mid-sized capitals Brisbane, Adelaide, and Perth in August. (Image supplied)

Taxes turn Melbourne into an investor no-go zone

Melbourne home values have now declined for six consecutive months, and CoreLogic cites a couple of reasons why.

"The increased tax burden on investment property owners in Victoria, as shown in an annual fall in the number of investment loans secured in the state reported by the ABS, may be dissuading some demand," Ms Owen said.

Paying the highest stamp duty in Australia, combined with the recent land tax increases and the lifting of the tax-free threshold have driven investors away from Victoria.

Landlords, in particular, have been singled out to help pay down the state's debt through the Covid-19 recovery levy over the next four years.

Furthermore, a short-stay levy is set to be introduced, targeting property owners who rent out their homes as holiday accommodations.

From 1 January 2025, investors will be required to fork over an extra 7.5% tax if they list their properties on accommodation platforms like Airbnb and Stayz.

These tax slugs have discouraged investors, leading to a 6.4% fall in new investor home lending, excluding refinancing, in Victoria over the 12 months to June, according to the ABS lending data.

However, Ms Owen noted that soft investor activity is not the only factor driving the decline in Melbourne.

Oversupply keeps the lid on prices

Weak demand, exacerbated by declining migration and affordability constraints, has been slowing the growth of median dwelling values in Melbourne, as well as in other states.

"Hobart and Canberra median dwelling values are also in decline, with interstate migration trends have been weak across Victoria, Tasmania, and ACT in recent years," Ms Owen said.

"Net overseas migration has also dropped, with the ABS data showing a decline from 165,000 in the March quarter of 2023 to 107,000 in the December quarter.

"These markets also had a stronger run-up in price growth throughout the 2010s, so it's harder to sustain demand while interest rates are high."

The increased availability of homes has also helped keep downward pressure on the overall dwelling market in these states.

"Supply is a big factor for Victoria, where the state saw more dwelling completions over the past decade than any other state or territory," Ms Owen added.

Similarly, ACT also saw a spike in unit completions from 2019 to 2023.

More dwellings are expected to hit the market soon, as Victoria recorded the highest number of homes greenlit for construction in July.

On a seasonally adjusted basis, Victoria posted a 20.1% monthly increase in total dwelling approvals (4,691) in July, accounting for about 32% of the total dwellings approved in the period, per the latest ABS building approvals data.

The total number of dwellings approved for construction across the country reached 14,797 in July, up 10.4% throughout the year.

This increase was driven by the staggering 33.7% bounce in multi-unit approvals.

Approvals for detached houses saw a more modest lift, up 0.3%, driven by sustained improvements in Western Australia, Queensland, and South Australia.

"The uplift in home building approvals in those markets outside of Sydney and Melbourne has been driven by strong economic conditions and the relatively lower cost of delivering a new home," Housing Industry Association economist Maurice Tapang noted.

Photo by Weyne Yew on Unsplash