In-store credit and personal loan specialist, Latitude Financial has launched a new Buy Now, Pay Later service called LatitudePay which can be used at 195 Harvey Norman shops. More shops and online retailers will be available for LatitudePay users in the near future.

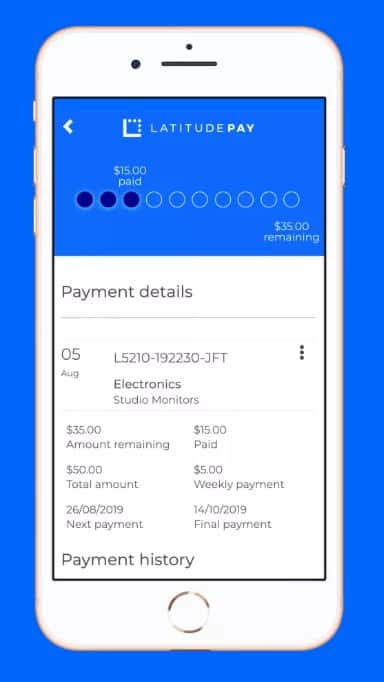

LatitudePay allows shoppers to pay for items over 10 weekly interest-free instalments.

1.2 million of the 2.6 million existing Latitude Financial customers are already approved for instant access to the new Buy Now, Pay Later service.

"LatitudePay is available to all Australians over the age of 18 who pass our quick credit check," said Latitude CEO Ahmed Fahour.

Unlike some other Buy Now, Pay Later services, users undergo a credit and ID check when they sign up.

After sign-up and approval, which Latitude says takes about 90 seconds, buyers are approved for purchases between $150 and $1,000.

There are no interest charges or fees if shoppers make all the instalments on time.

Late payment fees are capped at $10 for balances less than $50. Late fees can be up to $50 for larger balances.

Latitude builds on the in-store credit service that latitude already provides for Harvey Norman shoppers and a similar Buy Now, Pay later service already operating at Harvey Norman outlets in New Zealand called Genoapay.

"Bluetooth speakers, Fitbits, Beats headphones and Nespresso all top the list of products purchased using the LatitudePay equivalent, Genoapay," said Gerry Harvey, chairman of Harvey Norman.

"These aren't 'big ticket' items."

Ahmed Fahour said "In the coming weeks we will make a series of announcements about other leading retailers and eCommerce partners joining the LatitudePay platform."

How does LatitudePay compare with other Buy Now, Pay later apps?

The best known Buy Now, Pay Later app is Afterpay.

"Afterpay has millions of loyal users and is taking the world by storm," said Vadim Taube, CEO of InfoChoice.

Afterpay sign-up takes about 5 minutes. Users get to spread their repayments over four interest-free fortnightly repayments and a maximum time frame of 56 days.

A failed Afterpay repayment can attract a maximum $17 in late fees. Maximum Afterpay fees for unpaid accounts are $68 and you can be referred to a debt collector.

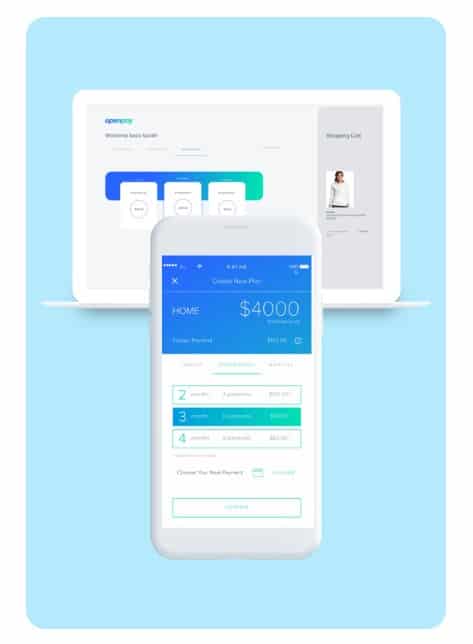

Openpay is another Aussie startup servicing the Buy Now, Pay Later market.

"We have a more nuanced approach to 'buy now, pay later,'" said Openpay CEO Dr Michael Eidel.

"We are more of a budgeting tool for people who earn their own money, have a family, a home, a car, a pet, etc.

Openpay has longer repayment plans and more flexibility in repayments. Customers can set their own repayment time frame, ranging from two months to 36 months on purchases up to $20,000.

Openpay is available at Bunnings, some health providers and health funds as well as many car repairers.

1.3 million Aussies now use Buy Now, Pay Later service Zip at 16,200 retail outlets.

Zip pay is for purchases under $1,000 and has no interest and a $6 monthly fee if you have an outstanding balance. Unlike Afterpay, Zip has minimum repayments of $40 per month but flexibility above that to set your own level of repayment.

months Zip processed 4.8 million transactions worth A$1.1 billion and is targeting an increase to 2.5 million customers during 2019/20.

The number of retail partners grew from 10,600 to 16,200.

Yesterday Zip announced the launch of a small business product, ZipBiz, a Buy Now, Pay Later service for business purchases worth up to $25,000.

Humm supports interest-free Buy Now, Pay Later purchases of up to $30,000 but the limit on fee-free purchases is $2,000. Humm has monthly fees if you adopt a repayment plan over 5 months.

There are late fees of $5 and an up-front application fee of $35 to $90 if you want the "Big things" option of spending up to $30,000 and paying it off over up to 5 years.

Which Buy Now, Pay Later app is best?

Each of the Buy Now Pay Later apps has pros and cons. The best one for you depends on your own needs.

Afterpay is popular with young people and is often considered to be "the millennial alternative to a credit card."

Openpay targets an older, more affluent customer who is managing cash flow, rather than looking for coins under the lounge cushions.

Zip is the brash newcomer taking on Afterpay for leadership in this category. Zip is also launching a Buy Now, Pay Later service for small business. Spending limits are higher than Afterpay.

Humm targets white good retailers and is designed like a line of credit. Humm was previously known as Certegy Ezi-Pay.