High brokerage fees, large minimum investment requirements, and the complexity of navigating financial markets have long been barriers for people with limited funds or financial knowledge to invest.

The Commonwealth Bank of Australia (CBA), through its online brokerage arm CommSec, launched CommSec Pocket in 2019 to cater primarily to beginner investors, offering them an accessible way to invest in the share market even with as little as $50 capital.

"Many people find investing in shares out of reach or too complex," CommSec managing director Richard Burns said.

"We've broken down those barriers by significantly reducing the amount needed to get started, reducing the cost of investing as well as simplifying the choices available."

What is CommSec Pocket?

CommSec Pocket is a micro-investing mobile app that enables users to invest small amounts of cash, starting from $50, into diversified exchange-traded funds (ETFs) with just a few taps on their phones. To make it truly easier for beginners like teenage investors or inexperienced traders, the app features a user-friendly interface and educational content that guides them through the basics of investing in the share market.

See also: Guide to Investing for Teenagers

CommSec Pocket users can choose from 10 themed ETF portfolios that include tech firms, international companies, sustainability leaders, and the biggest 200 companies in the Australian Securities Exchange (ASX 200), among others.

What are ETFs?

Exchange-traded funds or ETFs are passively managed investment funds that trade on stock exchanges. Unlike individual stocks, ETFs hold a collection of assets such as stocks, bonds, commodities, or a combination of these. While the value of ETFs can fluctuate, diversification helps manage the risk and stabilise returns over time, even if some assets in the basket don't perform well.

ETFs are designed to track the performance of a specific index like the ASX 200 or an industry index, such as health or technology. They can include not just Australian companies but also those overseas. However, it's important to note that buying units in an ETF domiciled overseas might incur foreign taxes.

Luckily, CommSec Pocket's ETFs are domiciled here and you won't need to worry about that. They ultimately offer an easy way for investors to gain exposure to a diversified portfolio of assets at relatively low costs.

How to use CommSec Pocket

To use CommSec Pocket, download the CommBank app and link a CBA transaction account to deposit funds. Once you're funded and linked, follow the steps below:

- Log into the CommBank App

- Tap the Investing tile on the app dashboard or Library

- Select Pocket ETFs

- Sign up

- Select the ETFs you want to invest in

From the app, you can select between investing lump sum amounts or setting up recurring fortnightly or weekly top-ups starting from $50. Each trade incurs a fee.

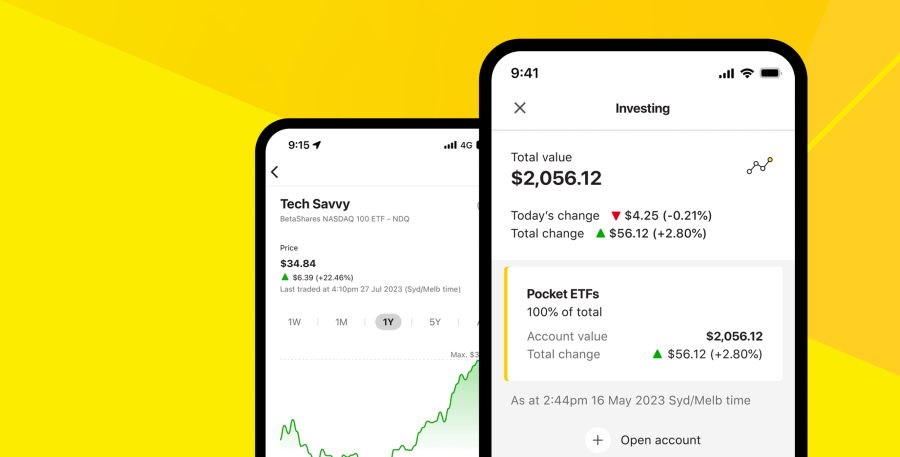

CommSec Pocket users can buy, sell, and manage their investments with a few taps on their phones. (Photo courtesy of CBA)

ETF options available on CommSec Pocket

CommSec Pocket currently offers 10 themed ETFs options (formerly seven), making it easier for investors to select investments aligned with their interests. However, the pre-set feature means users cannot create a customised portfolio of ETFs should they want to.

-

Aussie Top 200: Includes 200 of the largest companies listed on the ASX

-

Aussie Corporate Bonds: A selection of around 50 different Australian corporate bonds

-

Aussie Dividends: Includes around 30 companies in Australia known for paying strong dividends

-

Aussie Sustainability: A selection of 100 Aussie companies that have proven high environmental, social, and governance (ESG) performance

-

Diversified Equities: Provides a globally diversified equities exposure to roughly 8,000 companies listed on over 60 global exchanges

-

Emerging Markets: Gives access to more than 800 companies in fast-growing economies like China, Korea, and India

-

Global 100: Covers around 100 major global companies

-

Health Wise: Includes roughly 100 companies focused on medical innovation

-

Sustainability Leaders: Around 200 companies known for supporting positive ESG initiatives

-

Tech Savvy: Includes approximately 100 of the largest tech companies on the NASDAQ

How much does it cost to invest via CommSec Pocket?

While maintaining an account doesn't incur any ongoing fees, CommSec Pocket charges a $2 brokerage fee for each trade up to $1,000, or 0.20% of the trade value for investments over $1,000. For example, a trade worth $1,100 will cost you $2.20 ($1,100 x 0.20%).

An annual ETF management fee charged by the ETF provider applies and varies depending on the specific investment. These management fees typically range from 0.07% to 0.67% per year, and are deducted from the ETF's unit price.

A late settlement fee of $10 is also charged if the account has insufficient funds when cash is debited two business days after the trade settles.

What are the pros of CommSec Pocket?

Low minimum investment

Users can start investing with as little as $50, making it an accessible entry point for young investors and those with limited dollars to spare. Compared with other micro-investing apps, however, the minimum amount is actually higher. Spaceship and Raiz, for instance, currently allow users to invest as little as $5.

Themed ETF choices

The app offers ETF options focused on a specific theme, such as technology, sustainability, and emerging markets. The pre-set selection offers users exposure to a variety of industries and companies.

Automated investing

Users can set up regular investment top-ups with automatic contributions from their linked bank account, enabling them to be consistent in building their portfolios.

Easy account management

CommSec Pocket integrates with other CBA products, which means that with a few taps, CommBank customers can manage their investments alongside their everyday banking in one app.

CommBank is Australia's largest bank with more than 11 million Aussies having a transaction account with the bank; chances are you are a CBA customer so integrating your banking and investing is easy.

Educational resources

CommSec Pocket features educational tools and resources, such as key articles and insights, aimed at helping beginners understand the basics of investing.

What are the cons of CommSec Pocket?

Limited investment options

While it is great for those looking for straightforward selections, the limited range of ETFs and the inability to choose and invest in individual stocks can restrict diversification opportunities, especially for more experienced investors looking for a broader array of assets.

Higher relative fees for small trades

Although the $2 brokerage fee for each trade up to $1,000 is low in absolute terms, it can actually be costly for small investment amounts. To illustrate, when you invest the minimum $50 and are charged the flat fee of $2, you are effectively paying 4% of your investment amount, which can reduce potential gains.

Bare-bones features

CommSec Pocket is designed to be simple, which means it lacks many advanced features typically offered by more comprehensive, full-service platforms such as in-depth reports and stock analysis, custom portfolio building, and the ability to set limit orders.

CommSec vs CommSec Pocket: What's the difference?

| Feature | CommSec | CommSec Pocket |

|---|---|---|

| Minimum investment amount | $500 | $50 |

| Share trading | Yes | No |

| ETF trading | Yes | Yes |

| Trading fee | $5 - $29.95 for trades up to $25,000 0.12% of the trade value above $25,000 |

$2 for trades up to $1,000 0.20% of the trade value above $1,000 |

These are correct at the time of writing and are subject to change.

Founded in 1995, CommSec is an online trading platform that allows investors to buy and sell individual shares in the Australian Securities Exchange (ASX) and international sharemarkets like the New York Stock Exchange (NYSE) and NASDAQ. It also allows users to trade ETFs, warrants, and CFDs. In contrast, CommSec Pocket only enables users to invest in ETFs.

CommSec is accessible via web browser and mobile app. Users have access to live pricing, allowing investors to see in real-time what is happening to the stocks they choose to invest in. The minimum investment starts at $500 and trading fees are higher than those on CommSec Pocket.

In comparison, CommSec allows investors to trade a variety of securities whereas CommSec Pocket exclusively offers ETFs from the 10 themed options available. That said, CommSec is ideal for those who want more investment options and control over where their money goes, while CommSec Pocket is best for beginner investors looking for a straightforward and convenient way to invest.

Is CommSec Pocket right for you?

At its core, CommSec Pocket, much like other micro-investing apps, democratises investing by making it accessible and affordable for all.

With a low minimum investment of just $50, themed ETFs to choose from, and a user-friendly app, CommSec Pocket is good if you want to dip your toes into the share market, have limited capital, and seeking a simple way to invest. However, it's essential to consider whether the platform's limited investment options and features align with your financial goals.

While CommSec Pocket is great for beginners looking to start small, if you are a more experienced investor or seeking a broader range of investment opportunities, you might find its offerings too limited.

An earlier version of this article was written by Jason Bryce

Photo by Freepik